While a will dictates where your assets will go upon your death, an estate plan is a broader plan of action for your assets that may apply during your life and upon your death. An estate plan includes documents that detail what happens in the unfortunate scenario where you cannot make your own decisions and may also include Medicaid planning should you need long-term care in the future.

Shreveport Estate Planning Attorney

Experienced Estate Planning Lawyers In Shreveport, LA

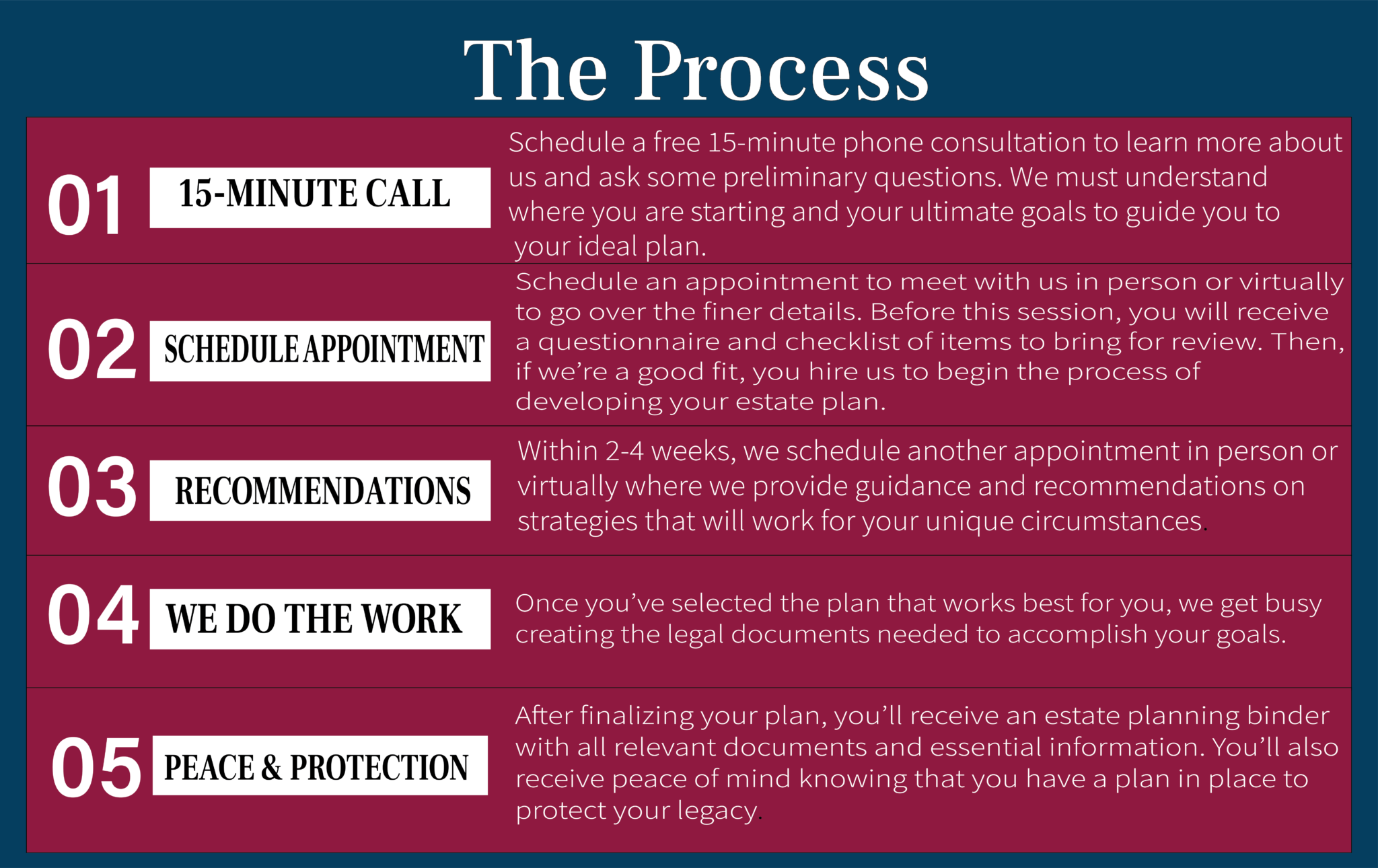

The Berg Law Firm aims to educate and empower clients through the estate planning process. A common myth is that estate planning is only for the elderly and the rich. That could not be further from the truth. Whether you are a young person just starting a family or an elderly adult in need of long-term care, our clients will experience the peace of mind that comes from planning for the future. Our Shreveport Estate Planning Attorney are here to answer your questions virtually or in-person in our Shreveport, Louisiana office location.

Why The Berg Law Firm?

Easy to understand flat fees

We’re not here to nickel and dime you. You will know what you are paying up front and what to expect from us.

Customized documents for your unique needs

No two families are alike; therefore, their estate plans shouldn’t be either.

Educational approach

We don’t just sell documents. We’re committed to educate and empower our clients to make decisions for themselves.

Open line of communication

We respond to all client requests promptly. Also, with flat fees, you don’t have to worry about additional charges when you have a question.

Non-judgmental, professional environment

We cultivate a safe environment for you to express your most intimate concerns so that we can ensure your plan suits your specific needs and addresses any concerns.

Why Now?

The myth that estate planning is only for the elderly or the rich simply isn’t true. Estate planning is for anyone who wants to save their family from additional grief on top of the stress and pain of losing a loved one. Most polls show that less than half of U.S. adults have a will with younger adults even less likely to have a will. Unfortunately, tragic situations happen to people of all ages. You can protect your legacy and your family with proper planning.

Frequently Asked Questions

Most frequent questions and answers

Why does having a will or estate planning matter?

Estate planning is essential because the State will decide the division of your assets at your death if you do not have one. Therefore, if you want to decide what happens with what you have worked for your entire life upon your death, you need to put the time into estate planning.

I believe Estate Planning is important, but do I need to do this now?

Yes. There are no guarantees in life. That includes living to old age. Ideally, it is best to establish an estate plan once you become a legal adult. It is not about how much money you have today; it’s about planning for your future and beyond. It’s empowering to make those decisions yourself. But equally important, if something happens to you, your loved ones will be grieving. Estate planning will remove the burden of what to do from them.

What is incapacity planning?

Incapacity planning falls under the umbrella of estate planning. It is a precautionary measure to prepare in case an unfortunate situation occurs leaving you unable to make your own decisions about finances and healthcare. Incapacity could occur due to a variety of tragic circumstances, including dementia, a car accident, or a stroke.

How much will this cost?

Estate planning isn’t one-size-fits-all, so we cannot give an exact figure without determining what strategies will work best for you. Ultimately, the cost will depend on the strategies you choose for your estate plan. We offer flat fee pricing, so you’ll know upfront what the costs will be for each strategy.

Education & Resources

12 Signs You Need To Review Your Estate Plan

Do you already have an estate plan? If so, congratulations! You’ve successfully taken steps to protect your family. However, an estate plan isn’t something that should simply collect dust on

What is Forced Heirship?

What is Forced Heirship? Forced heirship laws are unique to Louisiana. It’s basically a way to prevent parents from disinheriting their children. Who is a Forced Heir? Louisiana defines a

7 Estate Planning Mistakes

1. Not Having An Estate Plan in Place. The biggest mistake you can make is failing to plan. Failing to plan leaves the burden for your loved ones when you

Why You Need to Consider Incapacity Planning.

It’s not something people like to think about, but bad things can happen to anyone at any age. Whether it’s the result of a car accident, a surgery gone wrong,

Call the Berg Law Firm today for your free consultation

Request Your

Free Consultation

Fields Marked With An “ * ” Are Required

"*" indicates required fields